- cross-posted to:

- technology@lemmit.online

- cross-posted to:

- technology@lemmit.online

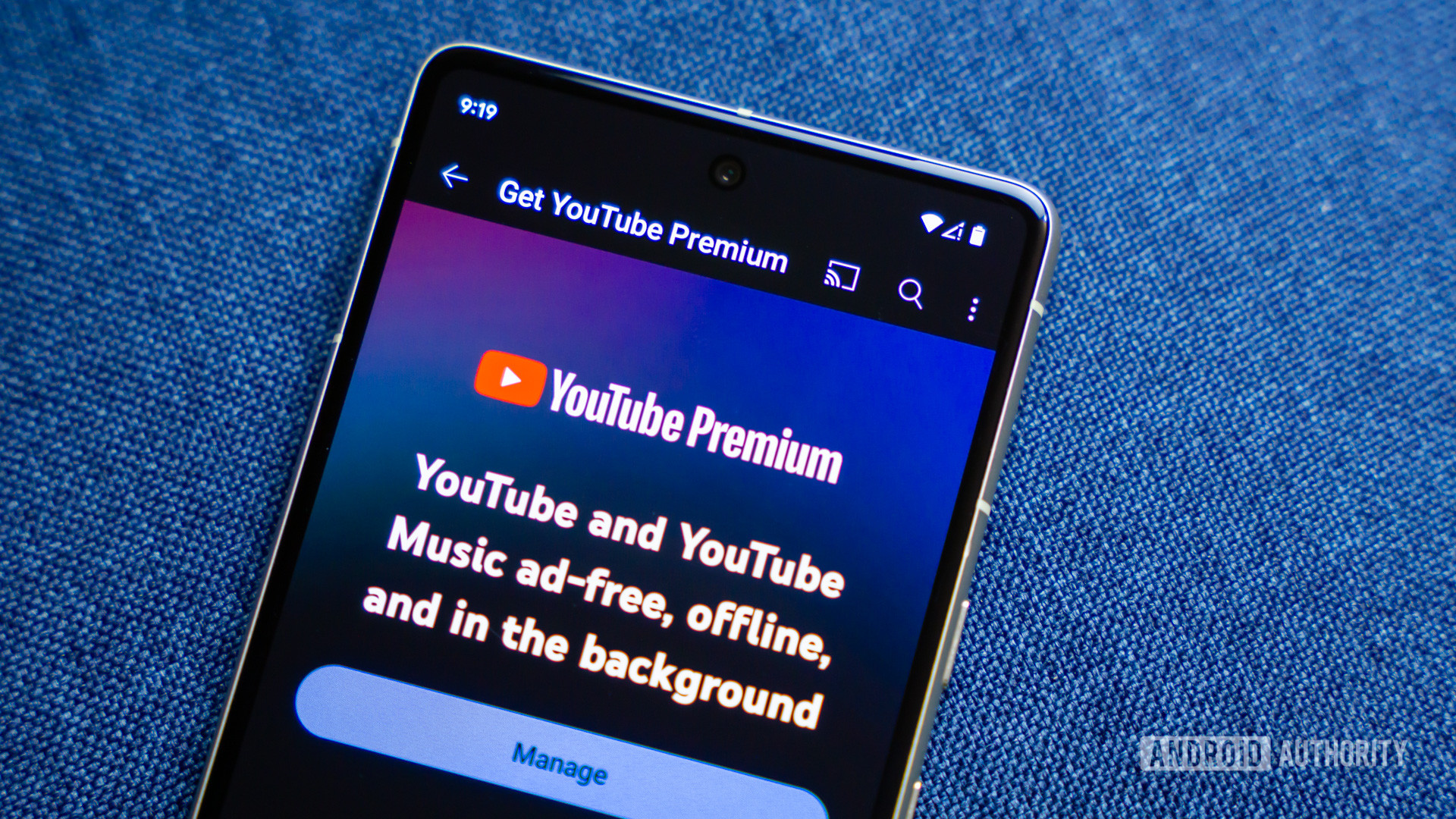

YouTube is increasing Premium prices in multiple countries, right after an ad-blocker crackdown | You either pay rightfully for the video content you consume, or you live with the ads.::Google is increasing the prices of YouTube Premium and YouTube Music Premium subscriptions in some regions, right after blocking ad-blockers.

Stock prices are one element of what makes business possible. Youtube would not even exist without this mechanic.

It’s like complaining that people have sex.

It’s a core facet of running a business. It’s a requirement and an expectation. This is part of “keeping the lights on”.

If you think so, you should explain where exactly the 1.624 trillions $ value of Google is, given that its net assets are about 267 billions $ and they had about 118 billions $ in cash (or cash equivalent)

Stocks are only a loan that a invenstor make to the company with the understanding that the company will repay it with a earning for the investor, nothing else. (well, it is not that simple but you get the point). Which is the reason a company always need to grow, because I buy your stocks today at 100 and I expect to sell them tomorrow at 101. Someone else buy your stocks tomorrow at 101 and expect to sell them next week at 103. That is indipendent from the fact that you have covered your operating costs in this week.

Youtube could exist even without this mechanic. True, it would not be as big as now or had the supposed value it has now.

It is the easy way to run a businness. A loan without the need to repay it.

The only element that “keep the light on” is that you have less cost than profit.

You can sell a cow for $1000 on the meat market. Or you can keep that cow, so that it produces milk for many years and earns you a total of $5000. This is the difference between net asset value and valuation. If you were to buy a cow, and producing a cow was next to impossible (cows are one of a kind, like unicorns), then the price of the cow would be closer to the valuation than its net asset value. And once you have that cow, as a responsible farmer you will milk it to the last drop, to get the most out of your money.

Now I’m sorry for the cow, but a business isn’t a living creature so exploiting it is ok.

The company isn’t necessarily expected to grow. Companies are expected to be milked. Sometimes companies don’t grow and that’s ok, they’re still being milked. The only requirement is that the owners of the cow, at any age of the cow, will believe that there’s milk in there somewhere some day.

It’s not a loan, it’s actual ownership. And the expectation is that people get something out of it.

YouTube would exist almost as a hobbyist site that has issues scaling its users and monetizing its activity. At some point it would have failed because people would find it frustrating to face the lags, and the owners (who by the way are still owners, who still invested in it, so actually very little changes in this mechanic) would introduce subscription fees or something in order to use the platform. Would it have become a ubiquitous platform as it exists today? Would you have it on your tablet, tv, phone? Probably not, but any of its competitors would have gone on a very similar journey and you’d be complaining about a different company, because you need investments in order to grow, become better, more attractive, and become both the way that people choose to upload content, and the way that people choose to consume content. And it would have been YouTube who couldn’t have afforded to keep the lights on at this moment.

I’m sorry, but that statement is as false as “developers get paid to much simply to press buttons. Anyone can do that”.

At the heart of this statement sits a conviction that you understand the topic, while you are missing some fundamental facts about it.

Why don’t you play a few thought experiments? Put yourself in other people’s shoes. If you were someone who had money, why would you put it in a loan that doesn’t have a need to be repaid? If you’re suggesting that the entire stock market rests on the “greater fool” principle, then maybe you don’t know about the end goal? Did you consider the “return on investment”? This literally is the very thing that powers the farmer who buys a baby cow, and what makes trillion dollar companies. Literally, the same instruments and calculations that financiers and CEOs of huge companies use day to day, my acquaintances who literally run their own pig farm, use every year - from options on feed, to futures on meat before even buying the piglets. The only thing they don’t do of this equation is stocks, since it’s a small farm and it’s owned fully by the family, and they don’t need to scale.

Only thing is the 5000$ are what you are hoping to get, not what you have. If you sell the cow to another farmer you will get less then 1000 $ (or maybe a little more), only a fool would pay you 5000$. Obviously I know there are some exceptions, but this is the normal situation.

This is because YouTube is something that people can do without. But there is no technical reasons why a paid service should have scaling issues. In the real world there are a lot of paid service that scale pretty well without any issue.

If people would find the service worth enough then people would pay the service. The boom of Netflix is an example: as long as people find it worth the price, they happily pay it. Once the service is not worth anymore (or not seen as worth), people stopped paying.

If a competitor had come out with a better service that was worth it, people would have paid it. Again, Netflix is an example. Only difference is Netflix also had to pay for distribution licenses and to produce shows, which add up other problems. Another example is Patreon: people pay to access things that they value worth the price.

Well, looking to how all the big stock exanges scaldals ends, I would say that there is nothing that make me thing that this is false.