a proponent of DRS, a proponent of GME, a proponent of the fediverse and freedom of communication.

- 35 Posts

- 24 Comments

1·5 months ago

1·5 months ago?

4·5 months ago

4·5 months agoBefore ATM After ATM (May 24) Shares outstanding (approx) 305,000,000 350,000,000 Cash on hand (approx) $1 billion $2 billion DRS % of outstanding shares (approx 75 million DRS) 24.7% 21.4%

2·7 months ago

2·7 months agonever left, not leaving. will be buying more shares and putting them in my name

thanks for your concern though

212·8 months ago

212·8 months agoyou could sell directly from computershare into a Wise account

it may very well be one of the last good opportunities to get some GME for cheap.

Either GameStop achieves full-year profitability, or they don’t.

GameStop’s opponents (those hedge funds and other participants holding a short position seeking the stock price to go down), and their useful bought and paid for media puppets, are well aware of the situation we are in, probably even more aware than most GME shareholders.

Full-year profitability is the target. It’s the thing that most shareholders and opponents have their mind on, in terms of material things that matter that could change the narrative, change the dynamic, and ultimately lead towards true price discovery.

If GameStop fails to achieve full year profitability, (e.g. net quarterly earnings for 2023 Q4 to be any amount less than positive ~ $57 million), then this will give the opponents an opportunity to pile on negative sentiment and hit the price down. “After 3 years in control of the company, Ryan Cohen and team fail to achieve widely-expected profitability, stock price down XX %”. As a shareholder I obviously hope that this is not the outcome, but I’ll be happy with any general improvements to the company’s financial standing.

but I think that this is a very achievable target. Net positive $57 million for 2023 Q4 will give full-year profitability for FY 2023. Any number above that is a major success, and completely feasible. Not guaranteed by any means, but realistically achievable.

And if this is achieved, then it shoots a giant hole in the persistent negative media narrative that has been put upon GameStop these past few years by dishonest and manipulative wall street incumbents and their dishonest and manipulative friends in the financial media.

in the scenario of full-year profitability, some positives with respect to an investment in GME:

- Full-year profitability. This would be the first year in 6 years that GameStop would achieve this profitability. The last time was in FY 2017. Undeniable evidence of successful turnaround efforts.

- cash in the bank to the tune of around $1 billion, unless significant amounts are spent on something such as an investment or a merger/acquisition, which would itself likely be positive news.

- no debt* (except perhaps the negligible French loan. it would be nice to be able to say no debt, definitively, without an asterisk. will this loan still be outstanding in any amount?).

- The video gaming industry is a $200 billion per year industry, and growing, larger than movies, music, and books combined.

- GameStop continues to make improvements to their business including for example in e-commerce, internal processes, new ventures

Obviously, not everything is sunshine and rainbows. GameStop still faces headwinds and has many competitors. In the long term, GameStop also needs to dramatically grow top-line revenue if it ever wants to become the giant that many shareholders believe it to be. These are not small accomplishments.

In the short term, in the face of the achievement of full-year profitability, and all the other positives that GameStop has going for it, how can the media sentiment towards GameStop continue to be so negative and cynical? Surely they will try, but it will become increasingly untenable to try and spin negativity about a situation that is very obviously positive. The negative media narrative is there to try and prevent additional investors from ever considering GME as a valid investment. But at some point the truth of the fundamentals become more powerful than the lies of the media. All it will take is some significant buying pressure and the price could break out.

Who knows what will happen.

I hope GameStop reports $57 million or more in net earnings for Q4 2023. We’ll find out in less than 2 weeks.

10·8 months ago

10·8 months agoi disagree with the assertion that heat lamp has been debunked, though it seems like some people really want people to necessarily believe this to be true and final.

put aside the name “heatlamp theory” and address 2 of the main points:

-

- Plan is not DRS. “Plan is not DRS” is not debunked, just because GameStop rejected the shareholder proposals, or that there were issues with the shareholder proposals. The simple fact remains, that plan shares are not DRS shares.

-

- On some DRS record dates, there have been large spikes in volume. Heat lamp offers a possible explanation for how / why. It is a theory, and it isn’t necessarily totally right. But, if not right, then how else are these volume spikes explained? To my knowledge, nobody else has put together a thoughtful explanation as to why volume of GME traded spikes on some but not all DRS record dates.

Okay, so heat lamp as originally proposed might not be the fully accurate explanation for the volume spikes. So what are the alternative explanations then?

Something worth noting is that there seems to be a very effortful push to authoritatively declare “DEBUNKED!” without explaining specifically how it is debunked, and without providing any alternative explanations.

- Observation: GME volume spikes on some DRS record dates.

- Theory: “i propose that the reason why this happens is because…”

- Opposition: “Heatlamp is definitively debunked and there is no other explanation!”

Plan is not DRS is a true statement and is not debunked.

GME has unusual trading volume on some DRS record dates, this is another true observation that is not debunked.One theory that attempts to tie these things together might not be completely accurate but to my awareness is the most thoughtful explanation that exists thus far. I’d love to see alternative explanations but I don’t know of any. Superstonk mods by consensus are opposed to the notion that there is any validity to heatlamp theory, yet offer absolutely nothing else as an alternative.

TLDR: “heatlamp is debunked” is just another example of narrative control being perpetrated by a group of moderators of the largest GME internet community. More information is needed to make any kinds of authoritative claims.

-

exciting!

with respect to GME, filing date for Q4 is usually mid March

Quarter Filing Date Document Date Q4 2022 March 21, 2023 January 28, 2023 Q4 2021 March 17, 2022 January 29, 2022 Q4 2020 March 23, 2021 January 30, 2021 Q4 2019 March 26, 2020 February 1, 2020 Q4 2018 April 2, 2019 February 2, 2019

5·11 months ago

5·11 months agoit’s area.

4·11 months ago

4·11 months agogreat comment!

i tend to agree. i think the fediverse is probably the best model moving forward. it is a challenging problem!

11·11 months ago

11·11 months ago👍 🙏

21·11 months ago

21·11 months agome too! 💜

91·11 months ago

91·11 months agoFor sure.

with respect to bots, as of this time I don’t think it’s a problem that can be fully solved, although I do think over a long enough timeline the fediverse is probably the best suited to handle that problem.

I wanted to see a visualization of the relative size comparison, so I used the data that was available on Wikipedia, but this data is approximate at best.

1·11 months ago

1·11 months agothat’s my CEO and chairman!

he puts his money where his mouth is

1·11 months ago

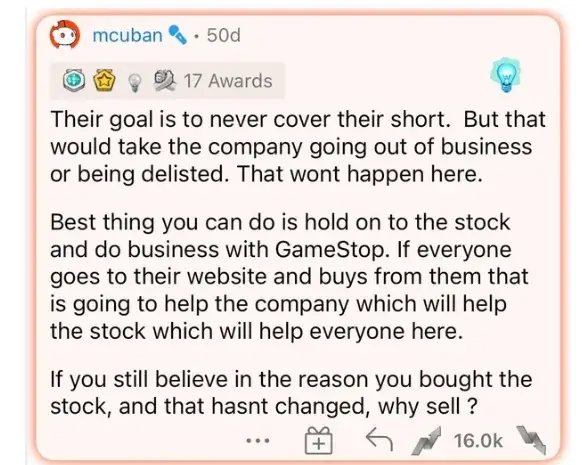

1·11 months agoCuban knows. “their goal is to never cover their short”

legendary comment that i think made a lasting difference in the opinions of many:

for Karl!

51·1 year ago

51·1 year agocult member checking in.

1·1 year ago

1·1 year agoBelieve it or not, I was banned from Reddit for trying to talk about DRS too much…

not hard to believe at all. Reddit’s and superstonk’s antagonism towards certain DRS conversations and the DRSGME.org team is one of the main reasons why this Lemmy instance exists in the first place. i wrote a post about it.

to this day, the mod team of superstonk is promoting Plan over Book, suggesting:

- investors should use scheduled recurring buys through Computershare (therefore putting their account into Plan)

- “it is insidious” that anyone ever suggesting people should turn off recurring buys

- it is sad that people sold fractional shares

- anyone who goes against the mod team is not acting in good faith

On the subject of good faith, the mods of superstonk:

- censored and banned all Plan versus Book discussions and DD in the superstonk subreddit

- they tried to censor any mention of such DD in other subreddits (r/DRSyourGME)

- when their attempts at total control failed, they pretended as if that DD was always welcome to have been posted in superstonk

- banned nearly everyone from the DRSGME.org team from the subreddit

- banned many other users who have otherwise questioned their authority

- now that most of the resistance to their authority has been eliminated from the subreddit, they continue to push the narrative that investors should engage in behaviors that result in their account being enrolled in Plan

- banned any mention of any alternative communities, banned the mere mention of the word “lemmy”

The superstonk mods have asserted their agenda over the subreddit and banned anyone that resisted their agenda. They ban anyone for suggesting that there are other places to go.

It’s almost as if the superstonk mods really don’t like pure DRS book, and they really don’t like people going to any places that might discuss things that contradict their preferred agenda.

I have a very hard time understanding how this could be, unless I consider the possibility that they have ulterior motives.

These are some great questions that I don’t necessarily know the answer to.

I imagine a discussion platform kind of like Reddit / Lemmy, but where moderators are all democratically elected. This would ensure that the community always has the power to remove moderators that aren’t serving the interests of the community. In terms of how changes are made, I imagine an environment that combines the best features of Github and Wikipedia, in terms of how changes are made and decided upon and applied for everyone. That there would be standard processes in place for making suggestions and changes, but that the ultimate power rests in the hands of the community participants.

You aren’t wrong, trust is obviously very important.

What I am trying to describe is the emergence of an alternative system that people could choose to use based on its own merit, similar to how bitcoin has emerged. While many people still don’t trust an idea like bitcoin, already many millions of people do trust it, and the aggregate value of all bitcoin is currently something like half a trillion USD because of this, because of the network effect, because many people do give value to it. As the years go on, as bitcoin continues to fulfill its basic promise of being trustworthy, of functioning as intended, more people will continue to trust it and use it because, while flawed, it promises a degree of inherent trust and functionality that is superior to the incumbent alternative fiat currencies that continue to lose more and more relative value every year due to irresponsibility and corruption of the central banks.

In this sense, a decentralized digital identity network would simply be a more functionally decentralized social network. The topic here is trust, and here we are in the fediverse because centralized for-profit social media companies are not preferred by people here, because of trust and other reasons. As the years go on, the experience of for-profit social media companies will have to compete with the experience of fediverse social media, and if fediverse social media is better, it will eventually emerge as a preferred viable alternative, and maybe even the predominant form of social media. People can choose to use it or not, but because of the network effect, as more people do use it, it increases its inherent value, which causes more people to trust it and use it, which continues to increase the inherent value, etc., until some thresholds are reached.

This would be true also of a hypothetical decentralized identity network. People could choose to use it or not, based on its merits. Many people would choose not to use it because they don’t trust it. But, as it would continue to grow and evolve and improve, like bitcoin, or like the fediverse, a larger number of people would use it and trust it despite it being relatively niche, it would continue to demonstrate itself as a viable alternative. In such a scenario of emerging naturally by competing with the incumbent systems, it is not inconceivable that such a system could eventually surpass a threshold and become the predominant social network and identity system in the world, that also provides effective functionality of things like voting on issues.

🤷

🫡