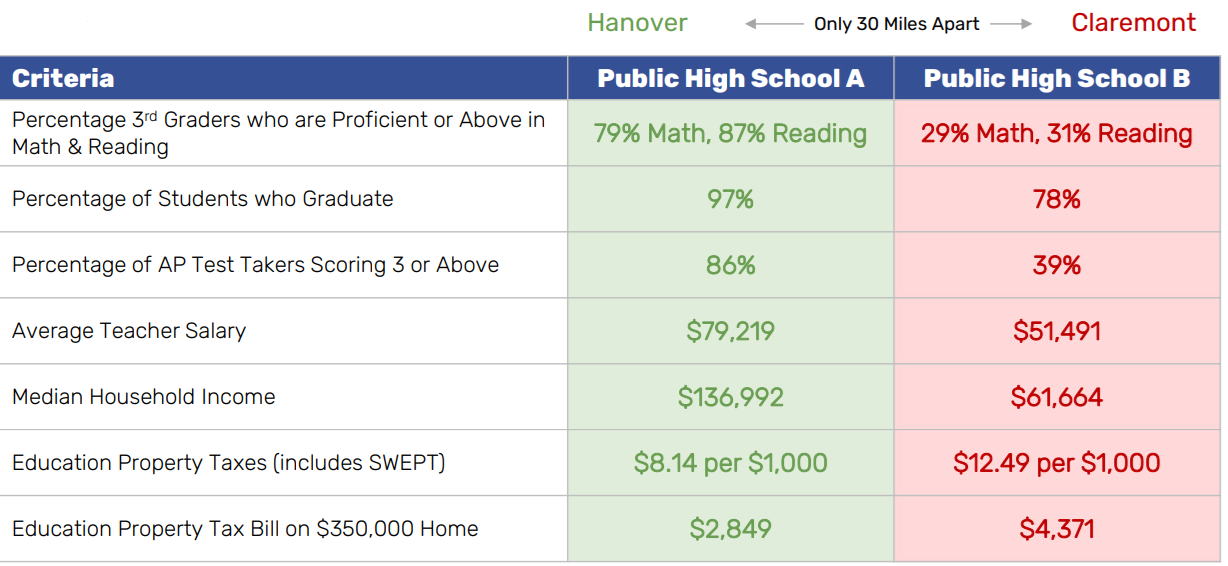

New Hampshire’s school funding system is the worst that exists in the US.

This image is pretty self-explanatory, but I want to add that this is not a cherry-picked example. There are other communities that could be compared that would show significantly larger disparities, but this example was chosen because they are 30 miles apart.

This disparity exists because most of the school funding comes from local property taxes. Property rich towns have plenty to spend on schools, while property poor communities must raise their tax rates. This causes businesses to leave, which lowers tax revenues, which forces them to raise tax rates even more. This also eliminates local jobs, which causes people to leave, which drives down property values, which drives down tax revenue. It’s a vicious cycle that destroys communities.

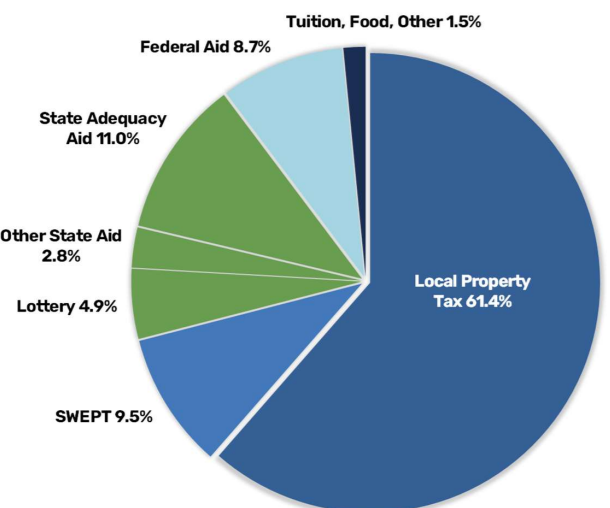

One of the aspects of this that enrages me the most is that the NH constitution requires the state to fully fund an adequate education. There was a series of lawsuits starting in 1998, where the NH Supreme Court ruled that the state must fund a study to determine the costs and fund that amount. As a result, the state legislature created SWEPT, a statewide education property tax. The funds would be passed to the state, and the state would be required to divide it out based on an equalization formula. This satisfied the court, despite the fact that the amount would not satisfy the cost of an adequate education established at trial.

Just 2 years later, the legislature passed a law allowing communities to retain the SWEPT funds, as long as they spent them on education. Property rich towns reduced their local property taxes to 0% and tried to spend as much as possible even though their schools were already well funded. Despite their best efforts, equalization funds still flowed to the poor communities, they just couldn’t spend it all. Then the rich towns discovered they could set a negative local property tax rate. Most of the richest towns did it, bringing their contributions to the SWEPT fund to 0.

Over the years since there have been other lawsuits, most targeted at aid for students with disabilities. Some of those resulted in some targeted funding and adequacy aid, but today the funding looks like this(SWEPT in this chart is the amount kept locally, so it’s a local tax as well):

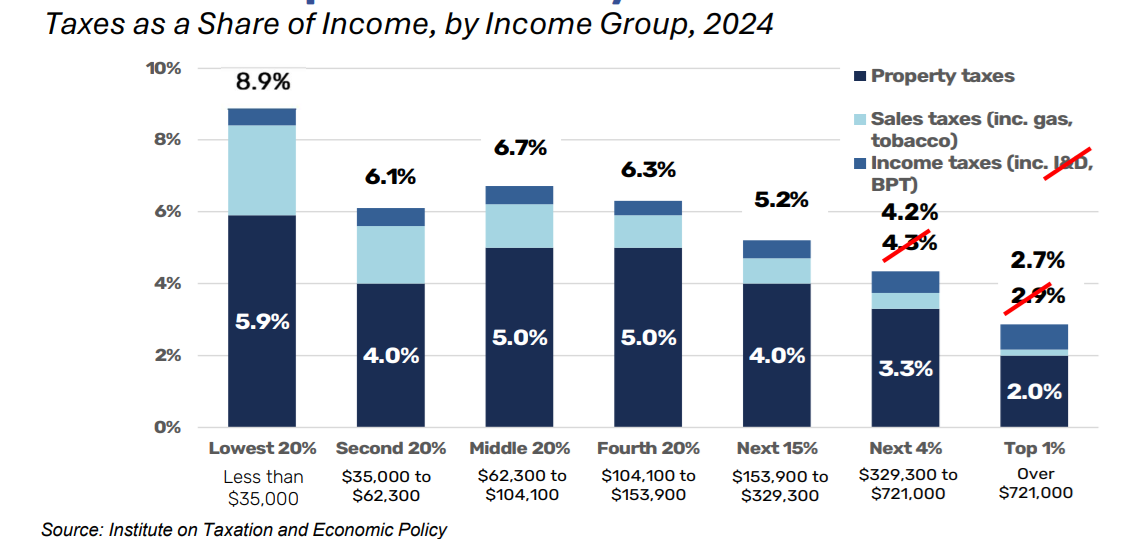

This whole situation also makes the entire NH tax system regressive, meaning poor folks a larger share of their income in taxes than the rich. There’s no personal income or sales tax and the interest and dividend tax was recently eliminated:

This is a system designed to keep poor people poor. Give them a terrible education, eliminate any chance of jobs in their communities, and tax them more than everyone that has a higher income.

There is currently another lawsuit going that the state has lost, but judgement is delayed until after the next legislative cycle. Despite the fact that the state lost, and didn’t even contest that they aren’t properly funding an adequate education, I’m not hopeful. The current chief justice is a big proponent of private education and represented the state in a previous school funding lawsuit. They also have the roadmap of how to allow the state to continue to violate the constitution. Let them delay, pass small reforms and then undo them, forcing another 5 years of funding studies and litigation.

For those not in the know, Hanover is where Dartmouth is, and Claremont is where everyone is dying of preventable illnesses.