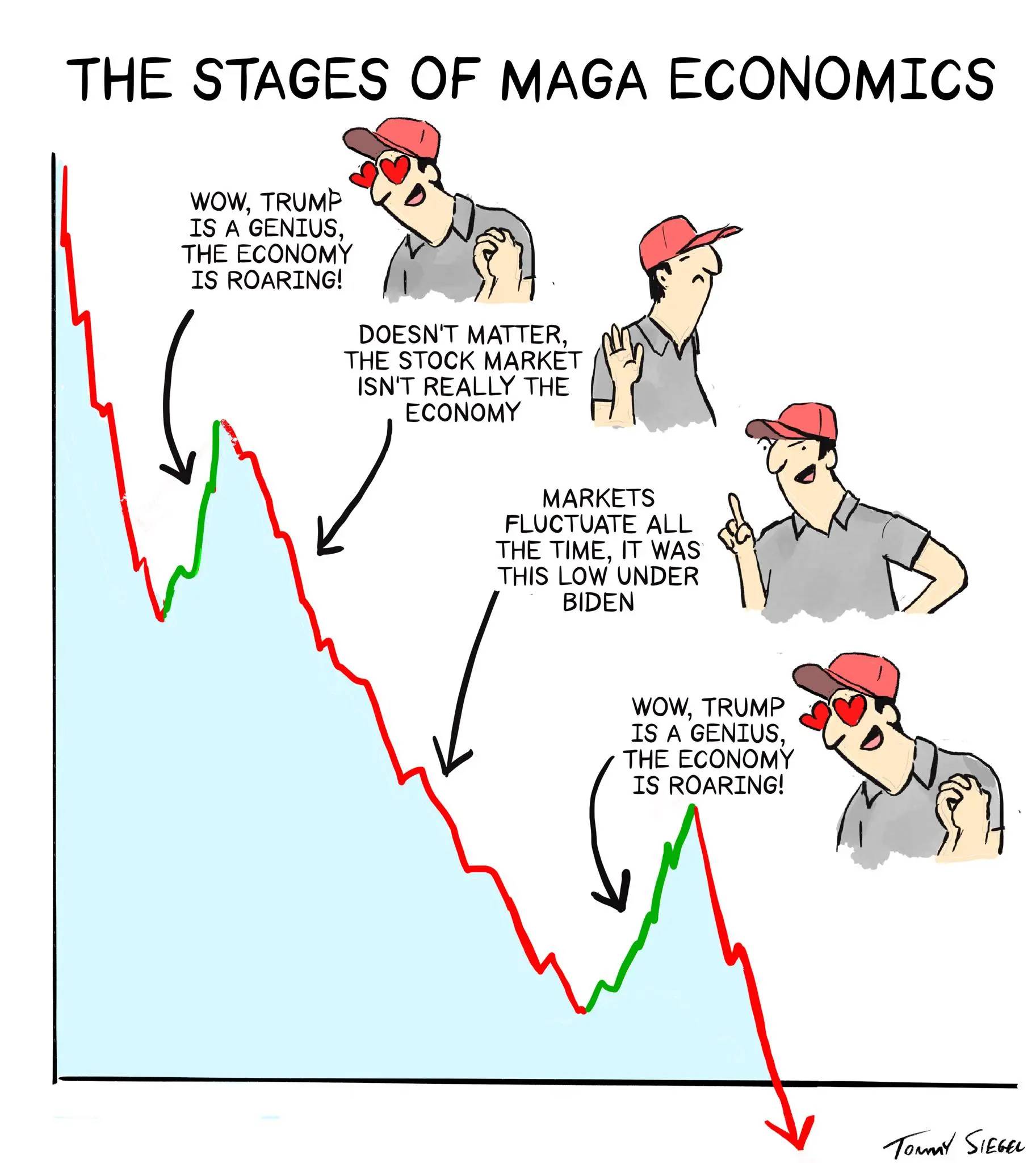

All things considered, it has only been about 3 months since Trump took office, I feel like there is absolutely no way that this was just a single craze and from here things will even out.

I feel like until 2028 (or maybe 2026?) S&P 500 is going to look like a roller coaster.

What do you think?

What climb? Its still down 8.61% since he took office. Crazy to celebrate losing almost 9%.

By contrast Biden’s second to last year was UP 24.23%. His last year was up yet another 23.31%.

To put dollars on this:

- If under Biden you’d put $100,000 into the S&P500 on Jan 2023 on Dec 31 2023 you’d have $124,230.

- If still under Biden you left your $124,230 in the S&P500 on Dec 31 2024 you’d have $153,188.01.

- Under trump if you’d put $100,000 into the S&P500 on Jan 2025 by today Apr 13th 2023 you’d have $91,390

I see no cause for celebration here.

And the bond market is in freefall… That’s not good, worse than the sp500.

I agree, yet so many are thinking thibgs are okay now, wild

What Trump is doing now will almost certainly outlast his presidency. One man, just one, has completely betrayed all of the trading relationships this country built over the course of a century, and even better, he did it unconstitutionally and Congress went along with it for their own enrichment, both Democrat and Republican.

Supply lines will be recalibrated. Our foreign partners will make new relationships with more dependable trading partners. (ie, China.) Over the course of the next decade or two, the utter stupidity of what Trump has done will play out to full effect. A few hundred Americans who shoved their heads up Trump’s ass will get richer, but long-term, this is going to hurt most Americans.

If you’re not diversifying your investments geographically you’re no longer diversified at all.

Most shitty things in our life can be traced to Reagan. Trump is going to outdo that legacy by so much.

We’d need an actual left wing president to actually undo the damage, and there’s no way the corporate democratic party is going to allow that

You’re right.

We needed a Bernie, and Democrats happily subverted their own primary process to prevent it. Now, all you can do is take whatever measures possible you can to ensure your own survival.

Bernie might have helped but even if he got into office Congress would have stopped nearly everything he campaigned on.

The administrative state would not have been torn up but that’s just tinkering around the edges. Things like IRS free file expansion or banking at the post office.

The supreme Court would belong to Democrats but…tinkering around the edges.

If Bernie got re-elected (no guarantee, his first term would have ended in COVID and broken promises, probably impeachment by a Republican house). 2024 would 100% have gone to a Republican.

We don’t need Bernie now. His plans are mostly just a harder crank on the ratchet. Good, but insufficient. We need Allende. Someone that wants to build non-mariet solutions to make our lives better, and a movement behind them in Congress.

I hope people realize that trump was able to do all this because of years of bad law writing and eroding of the balance of powers. All that concentrated power is great until someone you disagree with sits in the throne you built. It would be nice if after trump, we learn our lesson and vastly shrink the power of the office. Unfortunately , I believe it is likely people won’t realize this and will put even more effort into strengthening the power of that throne after trump is gone, in an effort to more quickly undo his work, which of course means someone will be able to redo the damage even faster at a later time.

Same.

None of this happened in a vacuum. The more you look at how we got here, the more it becomes clear that despite the theatrics we really are under one-party rule.

Biden had the chance to do it and outright refused to place more restrictions on the executive.

I’m not a both-sides’er, but one thing that both parties will absolutely never do is limit their own power, even if it means limiting their opponents simultaneously.

The President and his cabinet are, as we speak, violating the constitution. The Senate is complicit. The House of Representatives is complicit. The Supreme Court is complicit. We are past the point where voting for either Democrat or Republican can meaningfully change anything. We can’t vote to stop the assfucking that we’re getting, we just get to vote for who gets to be on top while it happens. This downward spiral will continue until a revolution occurs or by some miracle a majority of Americans wake up and start voting for new political parties in numbers that could threaten to topple both establishment parties away and implement sweeping government reforms with a strong mandate. Obviously, the way things are going, revolution is far more likely.

deleted by creator

Hi friend. There are a ton of options. Many invest in funds VT and VXUS, international funds run by Vanguard. SPDR is also a popular choice.

Take a week and just spend 30-60 minutes a day reading up on the various options in the global arena and make the best decision for yourself. The funds I mentioned above are a good starting point for doing your research and finding an option that fits your goals.

deleted by creator

I’m not an expert, but I’m an index fund/mutual fund guy. I’m not looking for a lottery ticket, I just want to keep up with the market.

They’re basically the new savings account, right? If they don’t do well, chances are nothing really is, so your money is stagnating to the same degree as everyone else. No real loss.

Index funds are a great option, no doubt.

European Aerospace/Defense ETF - ticker EUAD

If a Democratic president is able to take office following the fuckery happening to basic voting rights, I fully expect the cycle to continue of the Democratic president being blamed for inflation/recession due to transferring wealth to people who don’t need to spend money from those who do (thanks, tariffs) in the first part of their term. Any economic gains at the end of their tenure will be conveniently ignored.

My next vote goes to:

Sweet Meteor of Death 2028

I have a feeling that greed will entice folks to continue trading with the US, but also while they diversify their trading partners. This will increase competition and somehow the world will be better off after this clown show is over.

Trump will not make it past the mid-terms. Vance, who is the main mover-shaker behind the 2025 manifesto, will make sure the Senate impeaches Trump for treason, and the fact that under the Constitution he can NOT be President - an then Vance will assume the Presidency. If you think Trump is far-right, wait until Vance takes over. And since Vance was not ELECTED President, he can serve another two full terms - 10 years total. At the end of the ten years, The top 20% income earners - some 70 million Americans - will be living in luxury while the 0ther 80% will be nothing more than indentured servants. The Handmaidens Tale will be mild in comparison.

It could happen, but I think you’re wrong.

Trump is going to live to be 100 years old, like Kissinger did. The problem with your theory is that, after his first term, people know full well that he can’t be controlled.

Vance does not think so. Fact is, Trump is far too EASY to control by those around him. Even Putin knows how to manipulate him.

You say that, and then he’s handing out confidential secrets in casual conversation just to look cool.

Just look at the last week of tariff flip flops.

Trump can’t be controlled, at least until Congress changes hands in 2026.

More likely they 25th him for his very obvious sundowning. Trying him for treason would be too likely to hurt them politically

Vance is in no way worried about what will hurt the Republican party politically. They let that concept lapse when they chose Trump as the candidate. By all previous political reasoning, Trump should have been a disaster politically, but that did not stop them.

The fact that the Supreme Court has already acknowledged that Trump should be disqualified from being President under the constitution for Treasonous actvity feeds right into their hands.

The tariffs alone would be enough to cause a recession. It’s not just that they’re large (even 10% is large by modern standards) it’s mostly that they’re so chaotic. I’ve read that most businesses are avoiding hiring, avoiding any expenditures they can, and just waiting to see what happens. Seeing what happens means keeping cash on hand, which means a drop in GDP. The numbers might have been juiced a bit by people making big orders and trying to get them done before the tariffs come into full effect, but once that’s done the pain is going to be much more visible.

In addition to the tariffs, there’s the firing of federal workers. There are about 3 million in the US, and even if only a fraction have been fired so far, I would bet the rest are cutting back on unnecessary expenses and building up a cash reserve in case they get canned. This will ripple through the economy too.

And then there’s the ICE stuff. People with green cards getting deported for exercising their first amendment rights, scientists being refused entry for a post they made on social media in their home countries, Canadian, German and British people being thrown in an ICE detention facility because of a minor paperwork mix-up. This is going to make tourists and business visitors much less willing to take a chance and visit the US, but this won’t hit until later. Big tourist season is the summer, and so the lack of business won’t show up yet. And some conferences were too close to cancel, but conferences for later in the year might be moved or cancelled.

And there’s the invasion threats against Canada and Greenland, and the tariff wars against Canada and Mexico, and the refusal to help Ukraine defend itself against Russia. The biggest visitors to the US were Canadians, Mexicans and Europeans, and all of them are going to be avoiding the country now. And, not just avoiding the country. People are trying to avoid buying US goods and services.

In addition, there are treasuries. Many are held by Japan and China. Even just acting purely rationally, they see the chaos in the US and know the US might not be able to pay its bills, or it might choose not to pay them. The risk has gone up. If they aren’t being purely rational and self-interested, they also know that they can hurt the US by dumping treasuries, so they’re doing that.

And then there are the scientists leaving the US, or choosing not to come. And there are potential international students who see how risky it is for anybody who isn’t white, male and christian. This sort of thing might take decades, but it’s going to hurt the US the most. So many of the world’s most talented people have come to the US and started businesses, but that is definitely going to slow down now.

Even if Trump were impeached and removed, and all his changes were undone with apologies, there has been some permanent damage done to the US by the MAGA majority. But, since it is a majority, since the MAGAs control the supreme court, the senate, the house and the presidency, there’s going to be a lot more damage done before there’s even a hint of a stabilization, let alone a recovery.

I think any rational investor is going to get their money out of the US, and the slight recovery the S&P 500 has seen in the last week is going to be dwarfed by the crash over the next few years.

I was so focused on the tarrifs this week that I forgot about the actual fucking threats of war against close allies 🤦

The close allies didn’t forget, trust me.

That’s what they hope would happen.

I agree with most of this. However I think there are additional elements that make prediction challenging.

First, if the US undergoes any kind of revolution in the next five years, the cultural effects you mentioned could by overwritten by more recent events. I realize this sounds improbable, but the transition from the New Deal era to global neolibralism was a revolution. “The Reagan Revolution” was an actual economic and social revolution. And we’re overdue for another.

Second, both the markets and the real economy were in an unsustainable condition before Trump. The pursuit of endless growth, the disruption of climate breakdown, the end of the US’ monopolar hegemony, and the return of extreme wealth inequality in the US made the status quo impossible to simply maintain. Big changes were coming even without Trump.

I maintain some optimism. I think anti trust regulation, climate-based financial regulation, and an embrace of market socialism could render the last three months to be the last gasps of the old order instead of another point in what has been a decline decades in the making. But it depends what happens next.

Unfortunately, revolutions are frequently bloody. I think Europe’s more gradual change post WWII has meant the future is arriving more smoothly there, with less disruption.

I suspect that if the US survives, people will look at 1950-2025 as a kind of golden age, despite all the societal problems. The US really had things easy. It was virtually the only advanced economy to come out of WWII intact. Every other country had to rebuild. For the first 20ish years, regulations from the Great Depression lingered, so unions were strong and taxes were high. All of that meant that you had families where a plumber could buy a house for a family with 4 kids even if his wife didn’t work.

Since the 70s, a lot of worker protections have vanished. High taxes on the ultra-rich have disappeared. But, the US has still had the benefit of having the Reserve Currency of the world. That has allowed the US to easily run big deficits, which has allowed growth that other countries couldn’t match.

I get the impression that the time of the US dollar being the world’s reserve currency are coming to an end. In addition, US companies and universities have been places that the best and the brightest wanted to go. That also seems to be coming to an end.

So, when the dust settles, if the US does manage to transition to a more socialist country with a better safety net, it’s still going to be rough for people. They’re used to 75 years of having benefits that most countries don’t get. Probably a better social safety net and a greater equality in wealth will make up for that. But, it could be that people who were alive at this time will look back at a time when the US was the hub of the world and miss that.

I get the sentiment, but I think it’s possible we might miss the benefits you’re describing less than you think.

For the average American, the biggest manifestation of what you’re describing was cheap electronics, trucks, and suburban developments. These kinds of benefits are a poor salve for the alienation and atomization that now besets us. We have been trained to try and fill the holes in our lives with crap while losing more and more of the time and security that affords actual contentedness.

I think a generation raised knowing and trusting their neighbors, able to walk to school and bike to work and possibly go home for lunch, where they can eat some veggies grown in a community garden on an apartment roof might not feel like they’ve lost all that much just because they can’t buy an exercise machine they never use for $99 at a Black Friday sale.

There’s a reason a lot of “poorer” countries greatly outpace is in satisfaction and quality of life surveys.

I don’t think Americans are going to know what they’ll miss until it’s gone.

I’m assuming you’re American. If so, have you ever lived outside the USA? I’ve lived in multiple countries on a few continents, including some time in the US, so I know what it’s like to be in the “hub of the world” vs somewhere else.

Yeah, the US has social problems, there’s too much materialism, produce is widely available, but often shipped from very far away, public transit sucks, and so-on. I get you. But, the US is also the place where things happen first. For example, most new gadgets are available first in the US. Most new Internet services are available in the US first. Other parts of the world might have to wait years for things to show up, sometimes they never do. I remember how absolutely shocking it was when Spotify was available outside the US before it was available inside the US, because 99.9% of everything else shows up in the US first.

And yeah, the exercise machine that you never use was $99 at a Black Friday sale. But, the cheapest that machine will ever be in say Spain is the equivalent of $200 or so, because it’s “made” in the US (or at least that’s where the company that owns the IP is based) and it has to be imported into other countries and there are additional fees, etc.

This isn’t just about gadgets though. The US healthcare system is awful, but many medicines are available in the US years before they show up other places. Part of this is that drug companies can make so much more money in the US. But, another important part is that often the best scientists and engineers migrate to the US and they’re the ones inventing and patenting these things. If you’re someone who needs a certain medicine, it can be frustrating to watch people in the US getting treated years before it’s available to you.

Then there’s media. Everyone knows how Hollywood is the main source of movies for the entire world, and most other media is similar. But, it’s not just that. For example, Americans don’t really care about football / futbol / soccer. But, the US market is so important that European clubs mostly travel to the US in the summer for events and tours. Every other continent would love to have these teams visit because almost every other country is nuts about football, but year after year it’s a trip to the US because that’s where the money is. It’s gotten so bad that the Copa America, the South American football championship has twice been hosted in the US in the last decade, despite it being the championship for an entirely different continent.

And, yeah, Hollywood. It’s where all the best performers go. Shitt’s Creek was a massive hit in multiple countries, and it was a Canadian production using a Canadian cast. But, Eugene Levy was the honorary mayor of Pacific Palisades, he mostly lives in LA. Catherine O’Hara was named honorary mayor of Brentwood, Los Angeles where she mostly lives. It’s the same with most of the cast (not that they’re all honorary mayors of their adopted home towns, just that they live in the US). Virtually every major Canadian director (Cronenberg, Cameron, Villeneuve) is based out of LA. It’s the same with most prominent actors and directors from most other countries. If they don’t live full time in the US, they at least maintain a home in LA and live there part time.

Even American sports, despite only being played in the US, tend to pull in the best athletes from other countries. There are NBA players from Germany, NFL players from Cameroon, MLB players from Australia. These are countries where the sport doesn’t even exist, and yet they’re drawn to the big paydays in the US.

The best analogy I can make is that the US currently has a gravitational field that attracts things there. It’s sometimes mild, but often it’s strong (especially with singers and actors). Once things end up in that gravitational field, the main audience or main market becomes the US. Americans tend not to notice this because they’re at the center of that gravitational field, and it just looks like everything happens to be near them. You have to live outside the US to watch things constantly flowing to the US, and to see how sometimes you have to fight against gravity to get them back.

Again, I think the effect you’re describing is real, but it’s also pretty gated in a lot of ways.

We have a lot of treatments first, but also widespread medical bankruptcy. A lot of people lack access to basic necessities.

I’m other words, I don’t think someone running out of insulin gives as Schitt’s Creek…

I completely agree with you. The real shit show hasn’t even started. The waves from the tsunami will take a while to hit.

I’m more concerned with the bond sell-off, that’s a very bad sign.

Can you explain a little further? I don’t know what you are talking about

The original reply was great, I just want to make it dead simple: if bonds continue to be sold off in these numbers, it indicates investors no longer believe in a future where the US dollar is the international reserve currency. This is very bad if you’re an American.

If you have 20 minutes to spare this video really helped clear it up for me.

It might seem unrelated at first, but bonds will be discussed approx. 5 minutes in, and the preceding parts helps lay the groundwork.

I’d later come to understand this is called Modern monetary theory.

Some of the greatest daily gains in the stock market are during overall crashes.

Increased volatility is generally a bad sign for an economy’s health.

This. Uncertainty destroys value. No-one can deny that Trump generates uncertainty.

S&P 500 is still up 5% over the last 12 months. Up 95% over the last 5 years. Any action on a shorter timeline than that is emotionally driven and should be largely ignored. Unless you’re day trading of course. You’re not, right?

That said, ya. We’re probably heading into a rough time.

We’re looking at negative GDP growth according to folks smarter than I am. 2 quarters of that and it’s probably a recession.

Additionally it looks like foreign investors are leaving the US Treasury market kicking up yields and foreign governments are getting uneasy about purchasing US made weapons or relying on US security guarantees which, again, reduces GDP both directly and indirectly.

2028 can’t come fast enough.

If we wait til 2028 we’ve all failed. He has already stated he’s finding a way for a 3rd term and is currently shredding the constitution. If we do not oust the man and his entire heritage foundation crony cuck ball lickers there won’t be any voting for you to do in 2027. Their goal is to take complete control and remain in power forever. It’s clearly stated in project 2025.

Yeah I know 2028 is gonna be lit

Optimistic of you to assume any of this will end in 2028. Trump and his fascist goons are already priming the electorate to accept a 3rd term. He’s not going away until he’s dead.

Using the stock market growth of the last 2 decades of global, neoliberal economic politics to council people to “think long term” about their investments at the start of isolationist, fascist economics policy is maybe not the best idea.

“Look at the past” only works when the past is still relevant. They are ripping up every norm and institution that made those past gains possible.

Yea but if you look at where S&P is today vs January 19th, it’s a much better representation.

Climbing? Wait the market opening react to the new semiconductor tariff bomb released 10 hours ago

Or walking back the laptop/phone exclusions, or China halting rare earth shipments, or…

I have a very hard time believing that the rest of the world will trust the US for a very long time, if ever, so I can’t imagine our financial situation is going to improve for anyone except maybe the ultra wealthy (as usual). I haven’t even looked at my retirement because it’s not like there’s much I can do besides stress about it.

i mean he postponed it for 80/90 days or something so i guess this exact thing is going to repeat itself, because to me that looks like it would be the most profitable for trump

It’s not the tip of the shitberg, it’s the edge of the shittacane, Randy.

I think Trump will dump and pump repeatedly until he’s stopped. Him and his billionaire bum chums will be absolutely raking it in.

Precisely. Vance will use Trump’s erratic behavior as a reason to have him impeached by the mid-terms, and then Vance will fulfill his goal of becoming President.

I’m constantly amazed by people who don’t remember his first term.

Are you people on dope?!

Was it this bad this fast? I Seriously don’t recall it being this bad.

It was horrible though. Maybe the COVID19 kinda overshadowed him. Though the time he asked that it be looked into to us UV light inside the body to treat the virus and the time he recommended injecting or drinking bleach were crazy

Was it this bad this fast? I Seriously don’t recall it being this bad.

It was pretty bad pretty quickly, but it was mostly changes in culture. Things like the “unite the right” rally happened pretty early on in his first term. Ultimately though, he was pretty hamstrung by an unreliable, rotating cast of supporting characters in his first term that weren’t all on board with turning the country into Nazi Germany part two.

He’s shed all of those people and now he’s surrounded by dyed in the wool maga. The GOP and the makeup of the supreme court are also drastically different this time.

But it was terrible his first term, so terrible people don’t even remember all or even most of it.

The only difference is he’s got people who do his insane demented ideas now. It took him awhile to get the turd circus going brcause of all the old school fascist republicans he appointed. Evil but competent men who knew when shooting oneself in the crotch was a bad idea.

By 2018 he’d fired them tho.

Also the fact that it’s his second (and last I’m pretty sure but damn I hate that I can’t be 100%) term so you know, “Last time, YOLO!”

His term launched with the Muslim ban. He tried to repeal Obamacare until John McCain stopped him and he had to settle for tax cuts to the rich like every fucking Republican.

He tried to bully Zelenski into providing him dirt on Joe Biden and launched the Biden laptop scandal on no evidence. But that was after telling people to inject bleach for COVID.

The first three years he was largely restrained by a combination of his own incompetence and establishment Republicans. He relied on them to figure out how to govern. The 2025 people saw that andwent to work to see it won’t happen again in their quest for Gilead.

No, he didn’t do anything to touch the economy until 2017 with that tax scam for the wealthy. And we saw the results of that with the Trump slump of the second half of 2018 - where he then bitched at the Treasury to reinstate quantitative easing (which built us up for the inflation shock post covid).

But none of those had such crazy results as tanking the global economy overnight.

Honestly I find all of the covid years kind of hard to remember, and I know a lot of people who feel the same. I bet that Trump 1 mostly gets wrapped up and suppressed with all the rest of the general trauma.

Trump was president for less than a single year during the COVID era.

It was a long ass year though

That “less than a single year” was at the beginning of covid, and his malicious and cavalier response to a global plague hitting american shores led to a million dead Americans.

He was way more impactful about what happened with covid then anyone else, from allowing people to fly in unscreened to the states, from refusing to send out masks and tests, to pushing UV/disinfectant/invermeton, for refusing to help blue states early on because “it was good politically,” on and on and on.

Hey I’m not saying it wasn’t the worst part of the COVID years, just that it wasn’t most of the COVID era…which is even being vague as to what the COVID era is or if it even ever ended.

I’m one of the crazy people constantly masking still.

He definitely had an outsized impact on the overall COVID response in mostly negative ways. I think the only thing he did that was good is fast-tracking the vaccines and even then he managed to screw that over because of all of the other things he was doing wrong.

Well, there are a lot of factors here that I expect would be factors, both increasing and decreasing what he does over the course of the term.

-

Right now, the Republican Party has a trifecta, and thus even GOP legislators who are not very happy with aspects of Trump are going to be very loathe to have fights with Trump, because this trifecta lets it pass lots of legislation that the Democrats would otherwise block; getting in a fight with Trump could mess that up. The incentives there will decline over the course of the term, since they’ll have increasingly gotten through the legislation that they want; Trump being happy becomes less-important.

-

A major reason for Trump doing well in the presidential election was public unhappiness with inflation under Biden. Major global tariffs would also tend to drive up prices, and Republican legislators are not going to be happy about that, even aside from recession issues. I’ve seen both Republican and Democratic legislators commenting on the fact that this would probably be politically-damaging to the Republican Party; that’s probably a source of pushback.

-

One threat that Trump has frequently made is to endorse a primary election competitor to a Republican legislator who doesn’t get along with them. This meaning something is contingent on Trump’s endorsement bearing weight, which requires sufficiently-high public approval of Trump in the district. If Trump takes unpopular actions, that endorsement matters less.

-

Just because you don’t see a lot of Republican legislators arguing with Trump doesn’t mean that it’s not happening, quietly. The Republican Party has good political reasons to keep disagreements behind closed doors. Mike Johnson has made a number of statements about how he has had an extremely difficult job dealing with people getting along; he’s an interface between the House and the White House.

-

What happens at midterms is going to be, I think, consequential. The Republican Party has good political reasons not to jam sticks in Trump’s wheels as long as he at least keeps things within bounds, and certainly not to do so publicly. The Democratic Party has good political reasons to constantly visibly jam sticks in Trump’s wheels. If the Democrats take the House in 2026, they have a lot of room to do things like initiate inquiries and demand information that they just don’t have right now.

-

Late in the term, Trump is going to care less about popularity; that’s why Presidents tend to do politically-controversial pardons right at the end. So he might be willing to take some particularly controversial actions at the end.

-

Late in the term, Trump is going to have a harder time making changes that last, because it’ll be easier to just reverse them or slow them from having effect. Trump laying off people at the beginning of his term is hard to reverse; said laid-off people probably aren’t going to just stick around for four years hoping to get their job back. If he does so three months before leaving office and his successor doesn’t like that, they’re probably largely just going to be rehired. So he has a hard time making lasting actions at the end.

-

Trump’s tariff policy is based on a very weak legal structure. Normally Congress sets tariff policy, not the President, but Congress passed a law some decades back that permits the President to impose tariffs in emergencies. Trump proceeded to declare that fentanyl was an emergency and then started declaring that he’d throw up tariffs left and right. Whether or not the tariffs on even Mexico have any real basis in addressing fentanyl is questionable. Tariffs on Canada on fentanyl grounds are extremely questionable, as very little fentanyl enters the US from Canada, and tariffs on most of the world are even more decoupled from that. There’s a pretty strong argument that he’s got no legal authority there, and the only reason that he’s able to do it is because Congress hasn’t taken action against it. Congress can, if it wants, simply terminate the emergency he declared, at which point his power also evaporates (and has some more-forceful options as well, like taking issue at the Supreme Court with whether-or-not his use of that power is actually in line with even the declared emergency, or, if a supermajority in both the House and Senate want, simply entirely terminating the Presidential authority to impose tariffs at all, and then override a Presidential veto). The Senate already had a bipartisan bill pass about terminating the emergency over the Canada tariffs; last I looked, it was expected to fail in the House — that is, this is a public statement rather than aiming to force an end — but it’s a shot across the bow where the Senate is taking issue with some of his tariff policy. Trump’s ability to take action on tariffs is deeply dependent upon Congress choosing not to involve itself. I’m skeptical that Congress will accept global tariffs, even if Trump wants them, and Congress has pretty straightforward routes to avoid them. My guess is that Congress has probably communicated some things about what it’ll actually accept to Trump.

-

Speaking even more-broadly, if it actually comes to some kind of real arm wrestling…the President has very extensive direct control over a large organization with millions of people, the Executive Branch. That’s what makes him powerful. But the reason that he has virtually all of that power is because Congress gave it to him in the past (“we authorize the President to have this much money to create a department and then tell it what to do”). Congress can take it away, and with a supermajority in each house, override Trump’s veto of such legislation. Even in areas where the Constitution very explicitly gives a power to the President, like commanding the military, Congress has written legislation to limit ways in which he can act, like the War Powers Resolution:

https://en.wikipedia.org/wiki/War_Powers_Resolution

The War Powers Resolution requires the president to notify Congress within 48 hours of committing armed forces to military action and forbids armed forces from remaining for more than 60 days, with a further 30-day withdrawal period, without congressional authorization for use of military force (AUMF) or a declaration of war by the United States. The resolution was passed by two-thirds each of the House and Senate, overriding the veto of President Richard Nixon.

During Trump’s first term, Congress passed legislation that disallowed the President from removing sanctions on Russia without going back to Congress and getting an okay.

Hypothetically, I imagine that Congress could probably impose a lot of restrictions on Trump, or even shift direct authority over Executive Branch departments to itself; it has, in the past, created a small amount of the bureaucracy that reports directly to Congress.

My guess is that the Republican Party does not want to see any kind of an arm-wrestling scenario like that, though, as it’d be really politically bad. It’d instead warn behind closed doors that it might be willing to do that, and ward off things reaching that point. Hell, the Democratic Party doesn’t want things reaching that kind of point either. But my point is, Trump’s got real constraints on what he can do. He cannot just go ignore Congress.

That’s mostly talking about constraints on Trump’s power. So, there’s a broader question here: will Trump continue to say outrageous things? My guess is almost certainly yes. He’s shown no interest in stopping doing so for either of his terms, and kept doing so right through his first term, so I doubt that that’s going to go anywhere.

EDIT: Looking at the executive orders and correcting an error above, the emergency that Trump declared to justify the global tariffs was a separate emergency from the one that he declared over fentanyl.

This was very interesting, but I feel like your arguments as to why things won’t be as crazy is mostly based on congress stopping him, but why do you think they will?

Until 2026 is there any real reason to believe that they will? What did they do up until now? This is one of the biggest stock crashes in US history and it feels like they rolled with it and made a profit buying low and selling high

but why do you think they will?

There is one good historical indicator here. Clinton, Dubya, Obama, Biden, and Trump all entered their presidencies with control of Congress and lost it at the mid-terms. That’s just too strong a pattern to assume it won’t repeat.

The problem here is that the supposed ‘opposition’ is the Democratic Party, who themselves rule as conservatives and, in deed if not in word, support what Trump is doing.

I think that Congress most likely has involved itself.

No it hasn’t! It didn’t do anything like pass a law to take away powers!

Congress’s first step is not going to be to take any of the sorts of most-extreme moves I listed above. That’d be far down the list of actions to take. What it’s going to do is to go talk to Trump, not in public, and tell him that this is not something that they’re going to go along with. My guess, as I wrote above, is that that has most-likely happened.

Several Republican legislators — Ted Cruz, for one — have said that a recession would produce a bloodbath for Republicans in the midterms. This is going to be them expressing publicly that this isn’t okay with them. Peter Navarro can say that he’s fine with a recession; that doesn’t mean that Congress would be.

They’ve also had the Senate pass a resolution on terminating the public emergency upon which his tariff power rests. The House wasn’t expected to also pass it, and Trump would probably veto it, requiring it reaching a veto-proof majority backing it if Trump chose to veto it. But it’s Congress publicly saying that this isn’t on.

Congress is not going to take the kind of most-extreme actions that I listed because Trump caused the stock market to take a dip.

Interesting, I understand your argument but I feel that it has a bit of the classic “too reasonable to be true” as in, I think you are assuming that the house would act reasonably. With everything that has happened, and the public statements of some of these people, I think a lot of them are very very unreasonable.

would produce a bloodbath for Republicans in the midterms.

This is almost certain. Every president for the last 30 years that went into office with Congress lost congressional control at the mid-terms.

-