Just let your wealth compound over time and you’ll be a millionaire, the advice goes. If this is true why aren’t more people rich?UNDERSTAND, SHARE & PUSH BACK

This doesn’t need to be a 20 minute video.

While money in a bank does technically grow exponentially, the real value (what you can buy with that money) of the account grows slower than the economy.

Meaning each year you can actually buy less with the money you keep in a bank account. This is why retirement accounts are typically tied to the stock market, to try to tie their growth more to the economy.

Most of the video applies to a Millennial and younger audience. These generations got screwed on the necessary components for compounding to work. Forced to pay for exponentially more expensive education than generations prior put them deep into debt right out of the gate. Further, they entered the workforce during the Great Recession which forever put them 10 to 15 years behind in earning power. Lastly, saddled with the two other things, it prevented many from buying homes which appreciate in value.

In short, the younger generations got totally screwed. The compound interest promise still works for X-ers and above.

I agree with the very ending premise: We need to massively tax the ultrawealthy.

It takes money to make money and I ain’t ever had the money needed to make more.

That’s because what it takes is time, a resource we are all limited on. The only way to accelerate it is to have a head start like already being rich or having money seeded from family or have enough spare income early on to front load it for growth. Instead, most start with nothing, make the least when we’re young, often not being able to even start saving and accruing interest until we’re older, and when we make the most money is near our retirement when that money has the least amount of time to accrue interest before we start eating into it to live off of. If you front load it with a lot of money you could line just off interest alone.

No amount of time will make you wealthy through compound interest with the current economic system.

While your money does grow in a savings account, the rate of growth is lower than the economy or real value of the money.

Just think about what a million dollars could have bought you in the 80s vs 00s vs now.

Yes your interest does also need to outpace inflation. Not seen a savings account that pays interest of anything like that right now. Nothing low risk is keeping up with inflation.

That’s the thing, interest rates are almost always less than inflation. The only reason they flip is because inflation needs to be brought down.

The reason for this is that the government/economic model is designed to encourage spending. Holding money is effectively lost “opportunity” so the real value of the dollar is always pushed down.

That’s the thing, interest rates are almost always less than inflation.

Savings account interest rates are almost always less than inflation, true! Even worse, interest earned on savings accounts are subject to taxation as income, so effectively your highest bracket of taxation (in the USA at least).

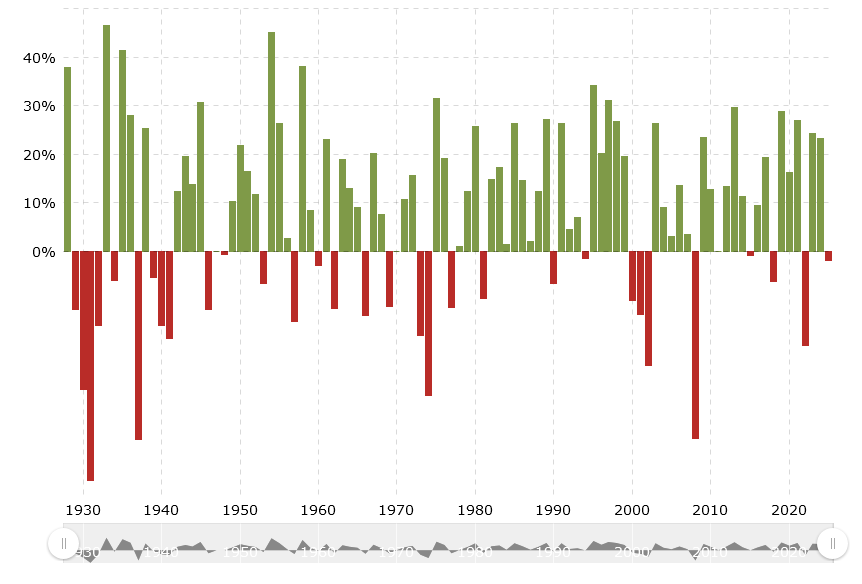

However, no one with even the smallest shred of knowledge of retirement savings will tell you to park your entire retirement budget in a savings account and expect any kind of healthy return. Savings accounts are VERY safe investments. The deposits (not interest) are backed the the federal government up to $250,000 per person (and per bank). For better returns you need more risk. The basic index funds in the stock market such as the S&P500 return an average of 7% per year over a long period of time. This means that some years will be in the toilet at negative returns, while others. Two years ago it was 24%! Even last year was 23%! All of this is also ignoring the massive benefit of saving for retirement in a 401k or IRA where you can skip or defer the taxation on retirement income achieving even higher effective returns.

S&P500 historical annual returns:

This mean that if you had $100 in a standard boring S&P500 index fund at the beginning of 2023, you’d have $124 at the end of 2023. At the end of 2024, having not invested another single penny, you would have had $152.52 at the end of 2024. A savings account with a 5% interest rate and that same $100 deposit would be $105 at the end of 2023 and $110.25 at the end of 2024. This small amount difference doesn’t sound like much, but now imagine it was some 35 year old’s retirement fund with $100,000. End of 2023 would have that value at $124,000 and the end of 2024 would be $152,520. So an extra $52k growth in just two years!!!.

My example above is compounding in only two years. Now look at all those green years and you can get an idea of the power of compound interest.

The reason for this is that the government/economic model is designed to encourage spending. Holding money is effectively lost “opportunity” so the real value of the dollar is always pushed down.

I know you’re saying this like its a bad thing, but if you really want to see the bad thing, imagine the reverse of what you said is true. Imagine the government was pushing deflationary position! Imagine your dollar would be worth more tomorrow if you didn’t spend it today. People would stop buying all but the absolute essentials. Why buy a car today for $30,000, when if you waited it would only be $20,000 next year. Suddenly cars sales drop to nearly non-existent. Auto workers would be put out of work in droves. That is just one example. It would ripple throughout the economy negatively.

Yeah, I was calling out savings accounts cause that’s what I imagine most people are talking about when mentioning compound interest. The video is talking about the false promise of compound interest and I wanted to call out the real reason it doesn’t work.

As for the standard 2-3% inflation the fed targets. I wasn’t saying it was bad, just that it means that you loose value if your money isn’t growing. I can’t say I studied economic theory far enough to have a meaningful stance on if that’s good or bad.

That’s because what it takes is time, a resource we are all limited on.

And patience, a quality most people lack.

There’s not enough patience in the world to make compound interest work for someone who lacks the expendable income upfront

You’re not wrong.

But there’s also definitely not enough patience on the part of people who do either.

Systemic failures aren’t character flaws.

Go knit that on a pillow, friend.

It’s not an argument. It’s a platitude.

It’s a statement of fact, you’re just butthurt because it’s a fact that completely destroys your delusional bootstraps bullshit

I don’t want to watch the 20 minute video but yeah, I started 30 years ago when it was possible to pay rent and put aside a little. I’m no longer putting any aside, my $75k a year job just keeps the lights on now

Millionaire doesn’t even feel very rich these days. I can’t retire right now but I’m worth a million bucks

Could you elaborate on that? At $1 million, that would be your yearly salary for over 13 years. At 5% yearly interest (from something like Discover) would generate $50k/yr. Why would you not be able to retire?

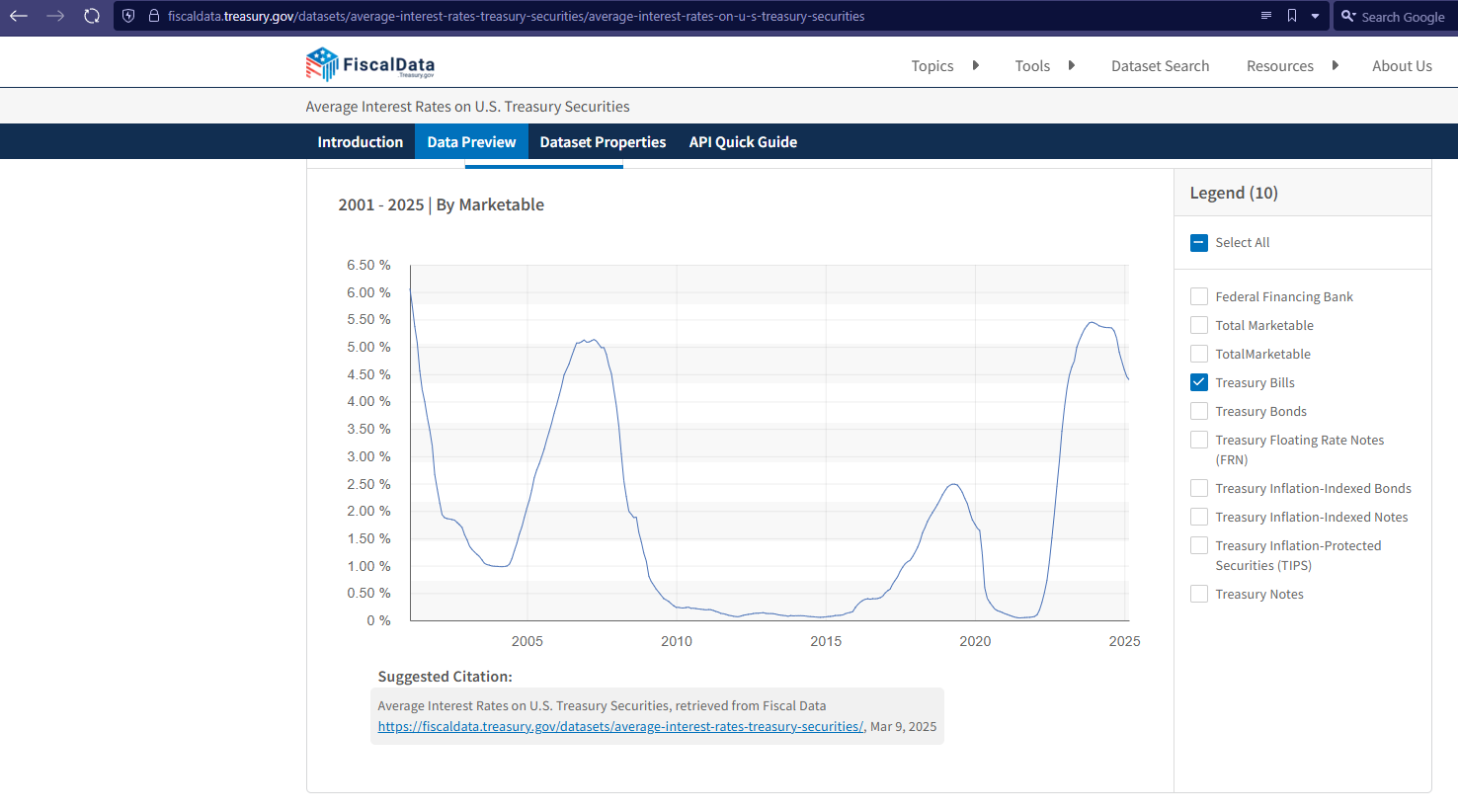

lol. 5% interest is a rarity now. The moment it starts approaching that, interest rates get cut. It never lasts. Discover is currently at 3.7%.

Kids.

Plus, $350k is just equity in my house.

edit: I guess I shortchanged my wife in that statement. We are full partners so half of it is hers

Could you elaborate on that? At $1 million, that would be your yearly salary for over 13 years. At 5% yearly interest (from something like Discover) would generate $50k/yr. Why would you not be able to retire?

I’m not the poster you’re responding to, but I’ve know the same math they used.

- Here’s the flaws in that argument. 5% interest is possible today in some money market accounts, but there was about a 17 year gap between now and the last time it was 5% was in 2007. These interest rates have a high correlation to Treasury Bills. So you can’t count on getting that 5% on the regular over the 40 years of your working life. Here’s a graph of the T-Bills yields over time.

- Even if you could, inflation will eat away at the value of your money especially over decades. So while $50k/year sounds like a decent amount of income in retirement, you’ll need substantially more money to maintain the same buying power. Example:

“$50,000 in 1995 is equivalent in purchasing power to about $104,222.77 today, an increase of $54,222.77 over 30 years. The dollar had an average inflation rate of 2.48% per year between 1995 and today, producing a cumulative price increase of 108.45%.” source

And that example is only over 30 years.

That poster is right. Being a millionaire these days doesn’t feel rich. This is especially true with the current administration attacking the social safety net with new restrictions on Medicaid and now Social Security is in his crosshairs. Lots and LOTS of us are going to be totally screwed in retirement. Even those that have enough for themselves and their immediate family are likely going to be sharing that with a close circle of extended family or friends to keep them out of starvation and exposure to the elements from poverty. None of us except the ultra wealthy are going to have a safe and happy retirement.

Yes that’s the last 30 years though. I’m not talking about past profits, I’m talking about the future. They seem to currently have enough money to secure at least a decade of spending even before taking interest into account.

Just don’t live longer than a decade, don’t experience inflation, and don’t grow old and infirmed.

I feel like I’m not being clear then: that’s ONLY taking into account the potential interest earned? Touching the principal, you’d be able to go for much longer. This is coming from a place of ignorance and envy as as American with no prospect of being able to save $1 million, ever.

I feel like I’m not being clear then: that’s ONLY taking into account the potential interest earned? Touching the principal, you’d be able to go for much longer.

This is the gamble though. The rule of thumb is a 4.7% safe withdraw rate. Once you retire, you’ve earned all the income from wages you’ll ever earn. What money you have saved will have to last you the rest of your life which is an uncertain amount of years with uncertain expenses. You can stack the deck in your favor by doing such things as owning your home outright, but that doesn’t shield you from the sky high cost of eventually having to move into an assisted living at today’s cost of $6000/month. Who knows how much that will cost in the future? So your $50k/year is completely exhausted by the first week of August having not spent another cent on anything. You’ll have to dig into your principle to make up the difference.

It’s just not safe. If I was on my own, me and my dog could ride into the sunset right now. I’m the main earner in our family, my wife takes care of the household and earns about $25k a year. Three kids, two in community college and we’re paying for it so there’s not even a little debt for them to start out.

I need a new truck and it would be a stretch to buy a used one right now.

Yeah I see, that’s fair enough.

I have not gotten anywhere near 5% interest the last 15 years. Best I did was around 3% and there have even been years with negative interest

I have received 5% at least the last few years, but even disregarding the last I’m talking about future spending.

I need compounds for there to be interest.

Gary’s Economics is an incredible channel